Can I Borrow Student Loans And Invest That Money

Saving vs. borrowing

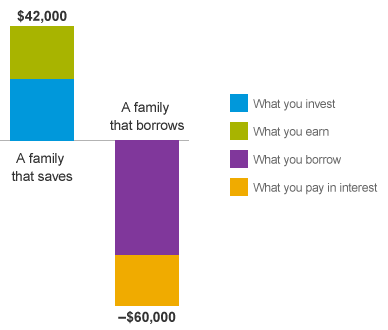

Student loans may seem like the answer to a prayer, but a dollar borrowed costs much more than a dollar saved.

Don't pay twice as much for college

A dollar saved is worth more than a dollar because the returns you earn will keep adding up. Unfortunately, the interest you pay on a dollar borrowed will keep adding up too.

A family that saves $23,400 (or $25 a week) over 18 years might have about $42,000 to use for college. Another family that borrows that same $42,000 could end up repaying almost $60,000.

Same education, more than double the price tag. Which family will you be?

Borrowing for college means you're paying a lot more

This hypothetical illustration assumes an average annual return of 6% for the savings, and a 7% interest rate and 10‑year repayment period for the loan. The illustration doesn't represent any particular investment nor does it account for inflation.

What about 401(k) loans?

By the time your child is in college, you'll hopefully have a healthy balance in your 401(k), and you may consider it as a source of college money.

It's not as good an idea as it seems. If you withdraw the money outright, you may have to pay income tax and penalties. And even if you take a loan rather than a withdrawal, you're hurting your retirement in the long run.

The money you take as a loan won't be available to grow while it's out of your 401(k) plan. That means less money for you to retire on. And while you can get a loan for college, no one will give you a loan for retirement.

Right now you may want to ease your children's way to financial independence by reducing their student loan burden. But if you run out of money 30 years from now, they may end up having to support you financially for years to come.

Our advice: Don't even consider using your retirement money for college unless you've already saved more than you need.

Get the basics on education savings

WHERE DOES COLLEGE FIT INTO YOUR PRIORITIES?

Can I Borrow Student Loans And Invest That Money

Source: https://investor.vanguard.com/college-savings-plans/save-vs-borrow

Posted by: logsdonprecand.blogspot.com

0 Response to "Can I Borrow Student Loans And Invest That Money"

Post a Comment